Do you need French mutuelle? France is renowned to have good public healthcare so what is this extra health insurance for? And why do 95% of French people have one? Let’s see what is it, why you may need one, how to choose it and what does it cover!

Table of Contents

What is a French mutuelle, the French complementary health insurance?

The mutuelle (the French for complementary health insurance or top-up health insurance) complements the reimbursements done by the French public healthcare (called Assurance Maladie or CPAM or even sécu).

In many countries, private and public healthcare systems are totally separate. In France, let’s say that they are “combined”.

The Assurance Maladie sets the basic fees for every single health treatment and reimburses a portion of it (often 70 or 80% when it is reimbursed).

Many doctors charge the basic fees (which are 25 euros for GP) but others can choose to charge more. The top-up insurance will cover the remaining amount between 70% of the set basic fee (of 25 euros for example) and the price that you have paid (either fully or partially).

Why take medical French mutuelle when living in France?

First, the idea of taking insurance is obviously to reduce cost if something happens.

Top-up insurance is to reduce the healthcare remaining costs. You may want to have one depending on your daily medical needs but also in case of unexpected health issues like hospitalisation for example.

Note that some healthcare treatments are not reimbursed by the French Social Security such as:

- dental implant

- some vaccines and medicines (FYI – the Covid-19 vaccine is free)

- alternative medicines

And also in general, the dental, optical and hearing treatments are not well reimbursed by the French public healthcare. And for some reason I can’t really get my head around, the preventive medicine is usually not reimbursed! And this even though the preventive treatment may be much cheaper than the curative treatment or operation…

Is it compulsory to have French mutuelle?

It is compulsory to have medical insurance in France, either with the Assurance Maladie or with a private one if you don’t meet the criteria to be covered by French public healthcare.

But the French mutuelle is not ALWAYS compulsory.

Let me explain:

- Supplementary insurance is compulsory for the employees of the private sector. Your employer has the legal obligation to take top-up insurance for all its employees via a collective contract since 2016. And to pay a minimum of 50% of the premium.

- On the other side, you have the obligation to take the insurance offered by your employer (unless you already have one, via your spouse for example)

Having access to a collective insurance contract can sometimes be better since the premiums are negotiated and often lower than the individual contracts.

However, the French mutuelle is not compulsory for other people like the self-employed or the freelancers. But many people choose to take one to cover unexpected health problems, but this is really a personal decision to make.

Can everyone choose their French complementary health insurance?

Not really… if you have a salaried position in the private sector, you won’t have the choice.

Either you take your employer’s coverage or your spouse’s one. You can also choose to keep the coverage you already have. But if you recently arrived in France and have no French complementary health insurance. The choice is made for you.

This is when you do not fall under the private sector employee category that you will first need to decide if you take up top-up insurance and if you do, you will need to find the one for you in the multitude of options.

How to choose your French mutuelle?

Know your needs

The first thing to do is to consider your needs and do not hesitate to compare offers to find the supplementary health insurance that best suits you.

There are a few things you need to take into account when choosing your French mutuelle:

- your health situation and your age

- your current medical care and the ones to come (for that it can help to take into account your medical history and your family history)

- Your family situation (do you have family members that need to be covered)

- What is your budget

- Your habits (do you use alternative medicine or do you often go to see doctors that charge more than the social security flat rate?).

How I chose my French mutuelle

When I left my private sector 9 to 5 (well it was more an 8 to 7 but this is another story…), I found myself in the jungle of the French complementary health insurance offers. It is not easy to make the right choice, even for French people… It is like a food menu, the more options you have, the harder the choice is!

I ended up using a renowned online comparator called Les Furets to help me in my decision. I won’t share here the French mutuelle I chose since it might not be a good fit for you.

I believe knowing the strategy to find the right one for you is much more valuable and it gives you the autonomy to choose the best option for you.

You can check up the Furet comparator by clicking on the below image. Unfortunately, I haven’t found a good enough comparator for French mutuelle in English, but Google Translate will help you in your research if you need it.

“Find your complementary health insurance in just 2 minutes” with Les Furets

Extra tip to understand the French complementary health insurance comparisons

Before I get into technicalities, you need to understand the reimbursement system of the French public health insurance. I advise you to read this post first.

Every comparator will be provided with the list of medical care and the level of coverage (usually a percentage) based on the Social Security pre-agreed rates.

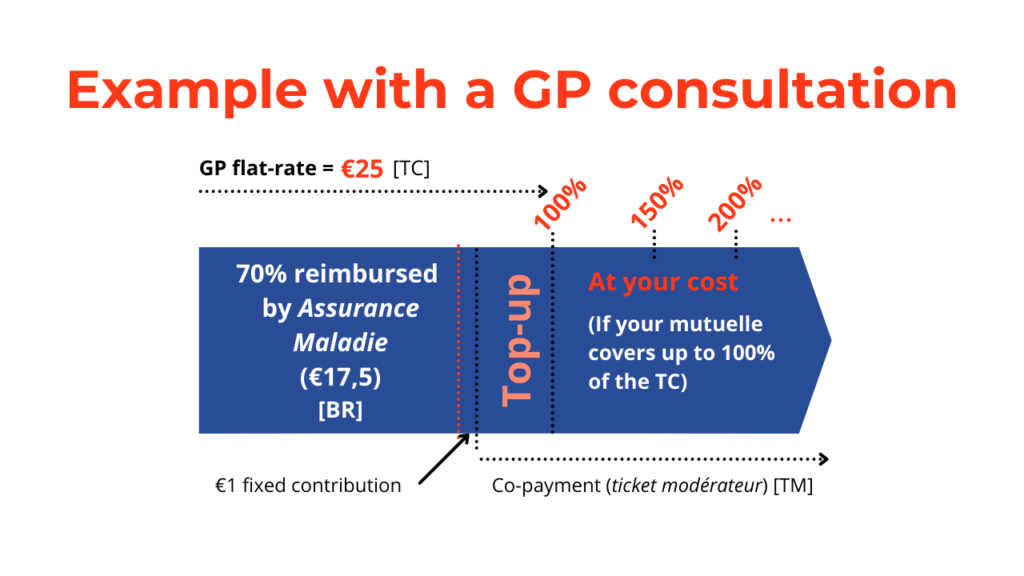

This is the basic fee or conventional fee also known as TC (Tarif Conventionné).

The public French healthcare will then reimburse part of this amount according to a predefined percentage, called the reimbursement rate (called BR).

It varies according to the type of care: 70% for a visit to the dentist, 60% for a hearing aid, 65% for certain types of medication, etc.

This is where your French mutuelle comes into play.

It will pay the part known as the co-payment (Ticket modérateur in French: TM), which represents the difference between the conventional fee (TC) and the reimbursement provided by the public health insurance. In other words, the remaining amount that you need to pay if you don’t have complementary health insurance.

The fixed contributions and deductibles will remain at your expense, except in exceptional cases (CMUC beneficiaries, pregnant women, etc.).

Let’s take an example to understand French complementary health insurance reimbursements:

You go to your GP, who is registered in Sector 1 (explained in the above-stated post), and who charges you the basic rate of €25.

The French Assurance Maladie covers 70% of the price, i.e. a BR of €18.50, from which €1 must be deducted as a fixed contribution (participation forfaitaire). So €17.50 as per the above example.

In this case, the co-payment represents 30% of the TC (Tarif Conventionné). Your French complementary health insurance company will therefore reimburse you the sum of €5.50.

And if you choose a mutuelle that covers no more than 100% of the predefined reimbursement rate (BR), you will still be reimbursed €5.50 even if you choose a GP charging a higher fee.

This is when good top-up insurance becomes necessary!

Then, what does French mutuelle cover?

The general rule

Usually the mutuelle covers the remaining costs (fully or partially) of:

- general medicine

- specialised medicine

- hospitalisation

- most of the medicines

- medical exams

- and personal carer services

However, the coverage level will vary a lot depending on the insurance companies and the level of coverage chosen.

The higher your premium is, the higher your reimbursements are. On the other side, the lower your premiums are the lower the reimbursement will be too.

So the important is to figure out and anticipate your needs depending on the criteria I’ve listed before. You may not need expensive coverage that reimburses well prescription glasses if you have perfect vision for example.

When you take top-up insurance, watch out for the waiting periods (délai de carence in French). This is the period when you start paying the insurance premium but are not covered yet. This waiting period varies from one contract to another. It is important to anticipate a change of insurance when you have expected health costs to come.

A good thing to know!

You can change top-up insurance every year on the anniversary date of your contract. You should receive a letter from your insurance company letting you know when your contract will be automatically renewed and you can end the contract up to 2 weeks before the contract is due. Your cancellation letter should be sent by recorded mail.

It is recommended to have found alternative insurance before if you end your initial contract.

Also moving away is one of the motives accepted to end your contract before the anniversary date.

In short

If you are not a salaried employee, the French complementary health insurance is not compulsory but highly recommended. Understanding that the coverage percentages refer to the pre-defined reimbursement rate and not the fee you pay your doctor will help you choose your coverage according to your medical needs.

I hope this helped you understand better the French complementary health insurance system!