More expats dedicated videos on Expat in France YouTube channel

Did you know French cheques are still commonly used in France?

It can also be useful for you to have a chequebook, you’ll understand why in this post. Let’s also see the pros and cons of using a French cheque (French check) and the rules you wouldn’t expect and of course how to write a cheque in French!

Table of Contents

Why is it a good idea to get a chequebook from your French bank?

When the cards are not accepted...

Have you ever tried to pay for a service by card and have been told that they don’t accept it? Only payment in cash or cheque would be accepted.

Many health professionals, independent doctors or small businesses don’t accept card payments. The payment terminal is quite expensive and French people still use cheques.

You may want to decide to get a cheque book from your French bank.

Let’s see why having a French cheque book is useful in France. If you are unsure of how to use a French cheque I will also tell you the things to be careful about. You will also know how to write a cheque in euros and what to do when you receive a French cheque.

It is free!

Until quite recently, the cheque was the only free way of payment. This was before the arrival of the new online banks in France.

You may have noticed that having a debit card or a credit card in France is far from being free. And that French banks charge many fees! For example, if you withdraw more than 4 or five times a month outside of your bank ATM network. Every bank has its own pricing policy but there is one constant rule.

The cheque book and its use are totally free of charge for the person making the cheque or the one cashing it! As long as they are French cheques…

Easy to keep track of a payment

When paying by cheque, you also fill out the check stub which is considered as proof of payment together with the money movement on your account matching the cheque number. This can be useful when an invoice is not given for example, but it also means that you should fill out your check fully. We’ll cover this further below.

The French cheque is handy when paying big amounts

Cheque payment is a common choice in France when you need to make large payments and the cards are not accepted. You can also negotiate several instalments or request a delay to cash your cheques with the receptor if you need.

The most common payment to make with a French cheque, besides the doctor’s appointment, is the security deposit. When moving into a long term rental, you will have to pay a one or two-month rent security deposit. Most people prefer to pay by cheque. It is essential to make sure you have funds available to confirm with the owner when it will be cashed, to avoid surprises.

Also compared to many other countries, the credit card is not as frequent as the debit card. So paying by check in several instalments is also a way to spread out payment and also avoid bank fees.

If you receive payments by cheque, keep in mind that the French cheque will be valid for one year and 8 days exactly. The date written by the emitter will be taken into account and past that date the beneficiary won’t be able to cash the cheque.

What you need to watch out for

What you wouldn’t expect

There are a few rules and practices that you may find surprising when it comes to using French cheques. Here are the main ones you should be aware of:

- The shopkeeper has the right to refuse cheque payments or can set a minimum or maximum amount for cheque payments. This must be clearly indicated at the counter.

- The shopkeeper can also request one or two proofs of ID with a photo to avoid blank cheques.

- Make sure you have the amount in your bank account as the cheque will be rejected if you don’t have the funds. Unless you have an authorised overdraft (however the overdraft amounts are usually limited. Check it with your bank)

- You risk a five-year ban on writing French cheques if you happen to make a cheque without funds and don’t rectify the situation.

- In case you lose or have your cheque stolen, you can cancel the cheque via the emitting bank.

- There can be a counterfeiting risk, especially when the check is not filled out properly. (We’ll see further down how to write a cheque in French).

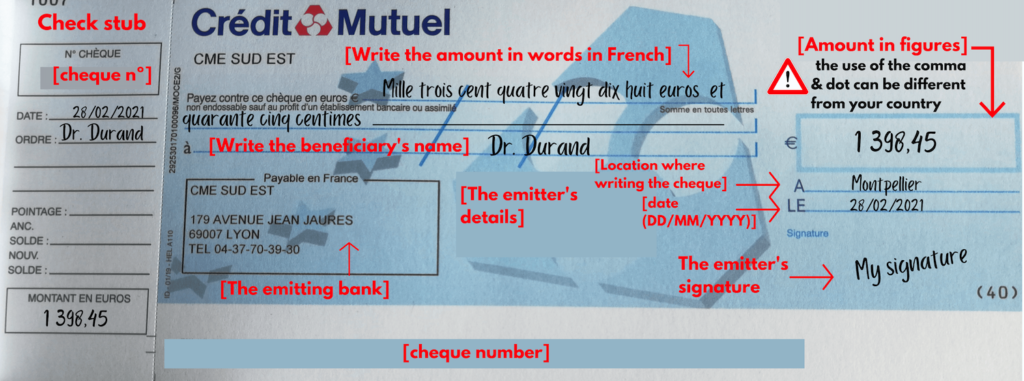

The correct way to write a French cheque

First, you must fill out the amount in letters, in French, at the top left-hand corner. Then, in figures in the square at the top right end corner. The two values must match. If there is a discrepancy, the bank will take the amount in letters into account.

This is a good opportunity to learn how to write numbers in French!

Watch out for the way you write the value in figures. In France, the comma is used before the cents, and the point can be used between the thousands and the hundreds. It is basically the other way around than Anglo-Saxon countries.

Then, under the amount figure section, you should write the city where you are when writing out the cheque. A just below the day’s date under the format DD/MM/YY.

Make sure you fill out the addressee’s name properly. Always confirm with the recipient how you should address the cheque.

And finally, sign the cheque.

For your own accounting, fill out the check stub by entering the value, date and addressee.

So now that you know how to fill out a French bank cheque, let’s see what you should do to cash one!

French bank cheque vocabulary

Payez contre ce cheque en euros: Write the amount in French (see the table below) – you can write the cents in numbers if you prefer.

à or à l’ordre de: Meaning “pay to the order”. So, write the beneficiary’s name. In the example: Doctor Durand. Also, Mrs will be in France Mme and Mr will be M.

€: Write the amount in numbers. In France, the comma is between the decimal as you can see in the example.

A or Fait à: Write the city where you are when writing the cheque.

Signature: Sign the cheque

Numbers in French French words to write a cheque

In letters in French | In letters in French | ||

|---|---|---|---|

1 | un | 30 | trente |

2 | deux | 31 | trente et un |

3 | trois | 40 | quarante |

4 | quatre | 41 | quarante et un |

5 | cinq | 50 | cinquante |

6 | six | 51 | cinquante et un |

7 | sept | 60 | soixante |

8 | huit | 61 | soixante et un |

9 | neuf | 70 | soixante-dix |

10 | dix | 71 | soixante et onze |

11 | onze | 80 | quatre-vingts |

12 | douze | 81 | quatre-vingt-un |

13 | treize | 90 | quatre-vingt-dix |

14 | quatorze | 91 | quatre-vingt-onze |

15 | quinze | 100 | cent |

16 | seize | 101 | cent un |

17 | dix-sept | 200 | deux cent |

18 | dix-huit | 1000 | mille |

19 | dix-neuf | 1100 | mille cent |

20 | vingt | 2000 | deux mille |

21 | vingt et un | 3000 | trois mille |

You can also find a very handy Number to words convertor here.

Cashing a French cheque

How to cash your French cheque

The French older generation, (but not only) still widely use cheque payments. They still have the habit to pay by cheque or request payments by cheque. And they will not always think to pay or receive payment by card.

So, if the French grandma gave you a cheque for your birthday or that your client sent you payment by cheque, let’s see what you need to do to cash it.

First, if you have an account with an online bank like Boursorama, ING… you should see with them directly as some online banks will request you to send the cheque by post and others will accept a digitalised cheque.

We will present here the process to cash your cheque if you have an account with a French bank that has physical agencies.

First, when you receive a French cheque, make sure the information on it is correct as explained before.

Then you need to sign the cheque at the backside and write your French bank account number. Some banks also provide a check deposit book. You should fill in one check deposit sheet and join it with your check. Even when a check deposit sheet is provided, it is still recommended to sign the cheque at the backside and write your French bank account number.

If you have an account with La Poste, you have been provided with prepaid envelopes specific to send your cheques to “La Poste cheque cashing department”.

Otherwise, you can bring your check with the deposit slip to your local bank. When the bank is closed you can put your cheque in an envelope and put it in the bank mailbox, or you can also enter the bank and use the envelopes specially provided to deposit your French cheque.

How to cash a foreign cheque in France

Also, you will be able to cash a cheque from another EU member state, however, you will have expensive fees to cash it.

I recommend you refuse any foreign cheques and ask the person to make a transfer.

You will have several options available to avoid crediting a cheque depending on where you are sending the money from.

If you are sending it from the Eurozone, a SEPA transfer will avoid you extra fees for payment in euros to or within another EU country.

However, if this is a payment from outside the Eurozone, I’m personally using Wise services! It is an international payment service that offers great Fx Rate and transfer fees about 10 times cheaper than most banks. From my experience, this is the cheapest and fairest option!

I’ve used it for transfers from France to the UK, for the UK to France, or from France to Brazil and I’ve always been happy. It is fast, easy, cheap and efficient. If you want to test it, you’ll get a free transfer of up to 500 EUR or equivalent by clicking on the below image.

To summarize

Paying by cheque in France can sometimes be needed but also practical when the only other alternative is a cash payment.

There are a few things to know, but with the above information, you’ll know more than most of the French people to feel confident using a French cheque for your next payment.

And if you are unsure of the French writing for the value, you can always check your online translation app or the convertor I provided above.

*** This post contains affiliate links. If you finalise a service through those links, I may receive a small commission, at no cost to you. This is a great way to support my blog if you’re planning to take this service anyways. Thank you for your support as blogging is not free 😉 ***

If you found this information useful, you can also follow Expat in France on Instagram for more French tips!

Mademoiselle Guiga from Expat in france

- How long is a cheque valid?

A French cheque is valid for one year and 8 days exactly. The date written by the emitter will be taken into account and past that date the beneficiary won’t be able to cash the cheque.

- Are cheques still in use in France?

Yes, you will still find people using cheque or requesting cheque payments. However, the cheque payments can also be refused since the card payments are done instantly.

- Can a foreign cheque be cashed in France?

Yes, however, most banks change expensive fees to cash non-French cheques. There are other cheaper ways to receive money in France with international payment services or SEPA transfers.

- Can you write a French cheque in English?

No, you should always write your French cheque in French. The French banks won't cash a cheque written in any other language. Number to words convertors are a great help to spell the French numbers in letters.

4 Comments

Sabrina

Thank you for these explanations ! It is true that I have never seen people using checks in any other country! I do use them sometimes, especially when I need to pay a big amount but I don’t have the money on my account yet, but I will receive my paycheck in a few days! As I know that paying by card is immediate, but paying by check will take a few days before you can actually see it on your account 🙂

Mademoiselle Guiga

Hello Sabrina,

Thank you for your comment.

Yes, the French cheque can sometimes be very handy, indeed!

Sarah D.

very well explained! I remember when I started to write cheques I was kinda stresses to mess it up lol! I remember practicing my signature too lol!

many foreigners going to France don’t know that it’s actually very common there and especially people from North America, they are usually surprised because here we barely use cheques…it’s all credit and debit cards! so thanks for this article!!

Mademoiselle Guiga

Hello Sarah,

Thanks for your comment!

Yes, the cheques are surprising to quite a few nationalities.

It can seem old fashion, but it can sometimes be useful. I, myself, don’t use it so often as I request a new chequebook every two years or so, but in some specific instances, it is always good to have it.