This is this time of the year again, one that no one likes but that every adult has to go through…the annual tax return… Being an expat in France makes the French tax return even more challenging!

I’m no tax expert. Only a professional tax advisor and the tax offices can provide adequate tax advice. They can, for example, advise on the specific expatriate tax regime. But I can give you some tips as I had to go through the same situation when I repatriated back to France, in addition to my 13 years of professional global mobility experience.

These pieces of advice do not replace the comprehensive support you would get from a tax advisor, but I hope they can clarify some essential and general elements.

Table of Contents

Do I have to file a tax return in France?

The tax return for year N relates to the income earned in year N-1, i.e. the previous year. So, it is not necessary to file a tax return in the year of your arrival in France. You will do so the following year, for the year in which you arrived. In the year following your arrival, you must confirm whether you are a French tax resident or not.

You should first consult the tax treaty concluded between France and your previous country of tax residence. If this does not provide information relevant to your situation, you must apply the criteria below.

However, it is recommended to request your French tax number in your first year in France, it will greatly facilitate your tax return process.

How to get my French tax number?

If this is your first time living in France, you have never registered yourself with the French tax office.

Your first step will be to get your French tax number and the creation of your online personal space.

For that, the French tax office requires the verification of your identity.

You must provide us with your civil status, a postal address and a copy of proof of identity:

- either at the counter of your local public finance centre

- or by postal mail

Once your identity has been verified, an e-mail will be sent to you indicating that you can create your personal space by entering your tax number and your date of birth on the authentication page of this site.

You will then have to enter your e-mail address and the password that you have chosen. You will then receive an e-mail containing a link that you must click on within 24 hours to validate access to your personal space.

Keep your tax number and password for future connections.

Tax resident or not

You are considered to be a tax resident in a country if you meet one or more of the following criteria:

- your household location (spouse or civil partner and children)

- the location where you are physically based to carry out a professional activity, salaried or otherwise

- the location of the centre of your economic interests. For example, the location of your principal investments, the registered office of your business or the place from which you earn the majority of your income

If you do not meet any of these criteria, you are not a tax resident in France.

As a French tax resident, you must file a tax return in France for any income earned in France and abroad.

If you are not a French tax resident, you only have to file a tax return if you have earned income in France.

How to file your first French tax return

Paper form or online?

The first time that you have to go through a procedure with the French tax administration it should be done on paper. French administration still loves paper forms! It could be for example adjusting your tax withholding rate, filing your first tax return or requesting your French tax number as explained before.

The paper documents must be sent by mail to the closest tax centre to your home. You can also deliver them in person.

The tax administration will send you your tax identification number (numéro fiscal) when this first procedure is carried out. This number is essential as it will enable you to create your online account.

Once you have your French tax ID, you will still be able to carry out your procedures on paper, but you will also to able to do it online.

Which forms to fill out?

Non-France tax resident

> Fill out form 2042: Main tax return form (for tax residents and non-tax residents)

France tax resident

> Form 2042: Main tax return form (for tax residents and non-tax residents)

> Fill out form 2047 (in the déclaration annexe tab for online declaration): to declare income that was banked abroad by a France tax resident. All types of income should be included, even though it may not be taxable in France.

> Fill out form 3916 (in the déclaration annexe tab for online declaration): to declare a foreign bank account

Back up basic documents to submit

- Passport copy and residence permit for each family member

- A copy of your lease contract (if applicable)

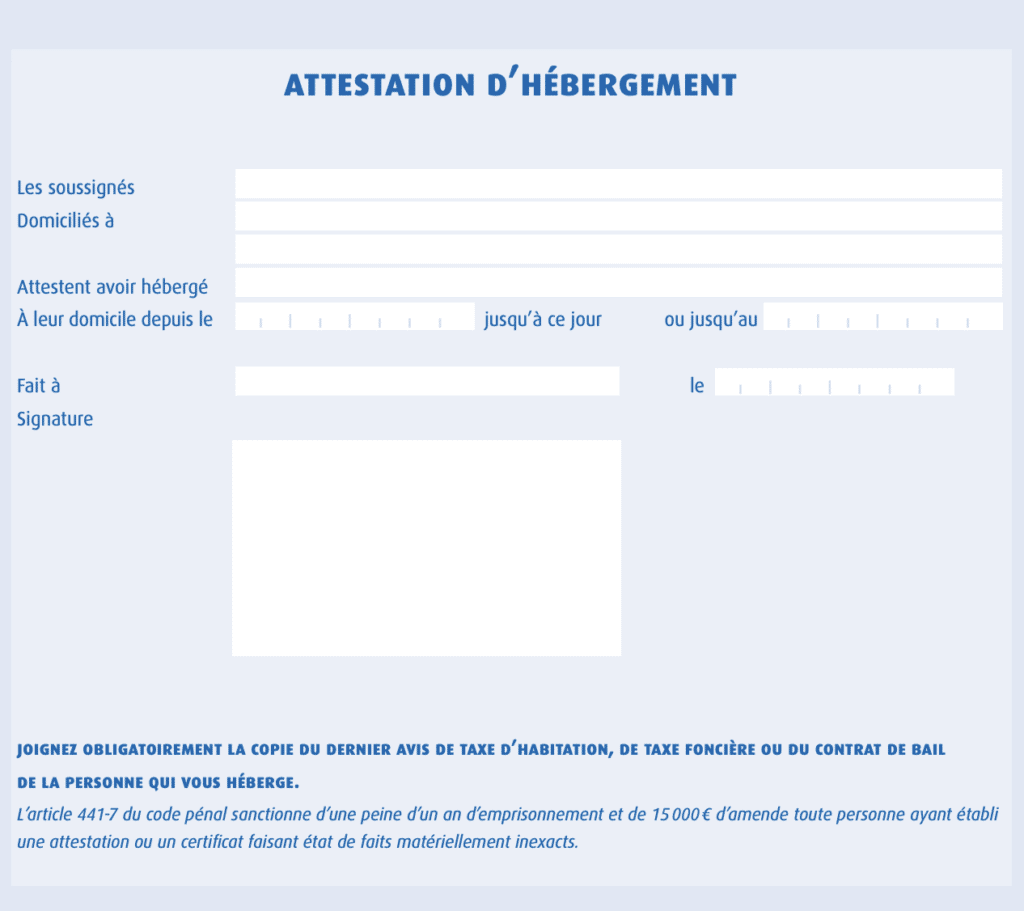

- A housing attestation if you are lodged by someone. Have your lodger fill in the certificate at the end of form 2042 (attestation d’hébergement)

- Children’s birth certificate copies (if applicable)

- Marriage certificate copy (if applicable)

What amount should you declare?

French incomes

At the bottom of your payslip, you will find the taxable amount. Your last payslip of the year (December or your last month in the company) will summarize the total taxable amount.

This is the amount you should declare. If you had multiple employers, you should add up the annual taxable amounts.

Foreign incomes

If you are a French tax resident, you should also declare your foreign income. If there is a bilateral agreement, it will specify the conditions to avoid double taxation.

Only the foreign income earned after your arrival date in France should be declared.

You do not need to include in your French tax return your income earned abroad before you arrived in France, only the income earned after your arrival date.

INSIDER TIP: As of 2020, tax paper forms are not sent out anymore. Use the above-provided form links to get the form online or make your online tax return if you have already been provided with your tax ID number.

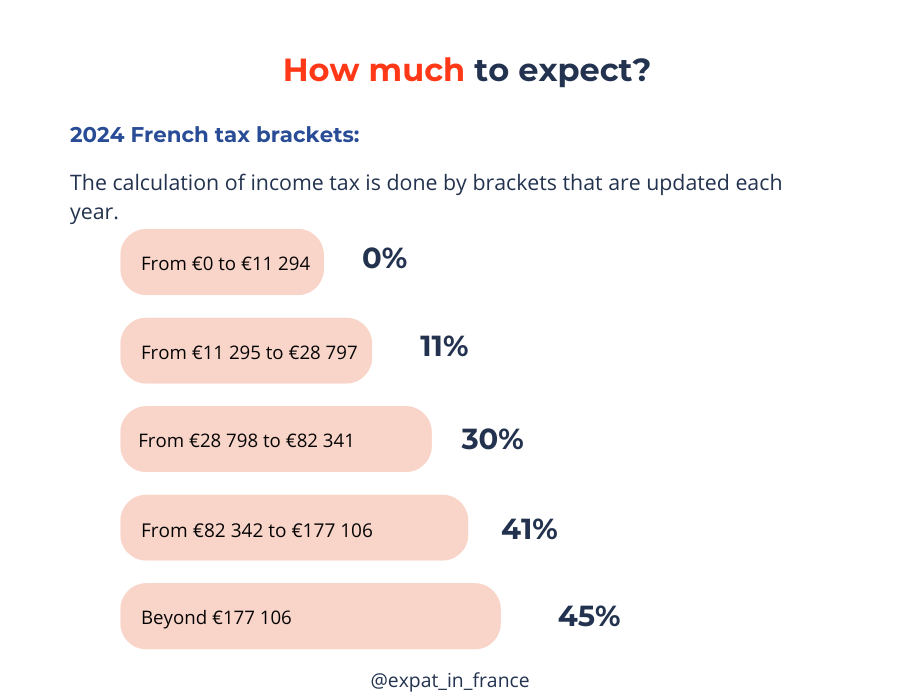

How much will I be taxed?

This is a question you should be asking a chartered accountant, but I can give you some elements. This information is incomplete and other elements explained in this article will also impact your tax calculation.

For example:

Mr and Mrs Smith are married with two children. Mr and Mrs Smith each have a net taxable income of €30,000, i.e. €60,000 for the household.

Each adult contributes 1 share, and each child represents 0.5 share. This means that there are 3 shares in the household.

To simplify, we say that each spouse chooses a tax rebate of 10%.

The tax income is therefore €60,000 – 10% of €60,000 = €54,000

54,000/3 shares = €18,000/share. They are, therefore, in the 11% tax bracket described above.

33,882 will not be taxed (3 parts*€11,294)

The rest (€20,118) will be taxed at 11%.

Bilateral double taxation agreements

To avoid double taxation, you should check the tax bilateral agreement between France and your previous country of residence. Also, make sure this is applied by the French tax office.

You can check the bilateral tax convention that France has signed with other countries, the link is in the description below. You will also be able to find it on the tax office website of your previous country of residence in the other language for a better understanding.

If you need further advice, you can contact the French tax office or a tax advisor. When you have determined that you want the tax bilateral agreement applied to your situation, you should send a request to the French tax office as follows:

- Prepare a letter request.

- Attach a copy of the tax treaty in question

- Provide proof of employment in France (work contract + work permit if applicable).

IMPORTANT NOTE: If a tax exemption applies to your situation according to the tax bilateral agreement and the exemption duration is shorter than your residence duration in France, the exemption will not apply.

How to personalize your tax withholding rate

If you are employed in France, a ‘neutral’ tax withholding rate has been applied from your first payroll. This rate is the highest one that usually applies to single individuals.

You can request a personalized rate to avoid overpayment that will only be reimbursed at the end of the tax year:

- Fill out form 2043-SD

- Provide a passport copy for each family member

- A copy of the visa for each family member (if applicable)

- A copy of your marriage certificate (if applicable)

- And a copy of the children’s birth certificate (if applicable)

You and your employer will be provided with your personalized rate within a few weeks. Your employer will, therefore, apply it to the following payroll.

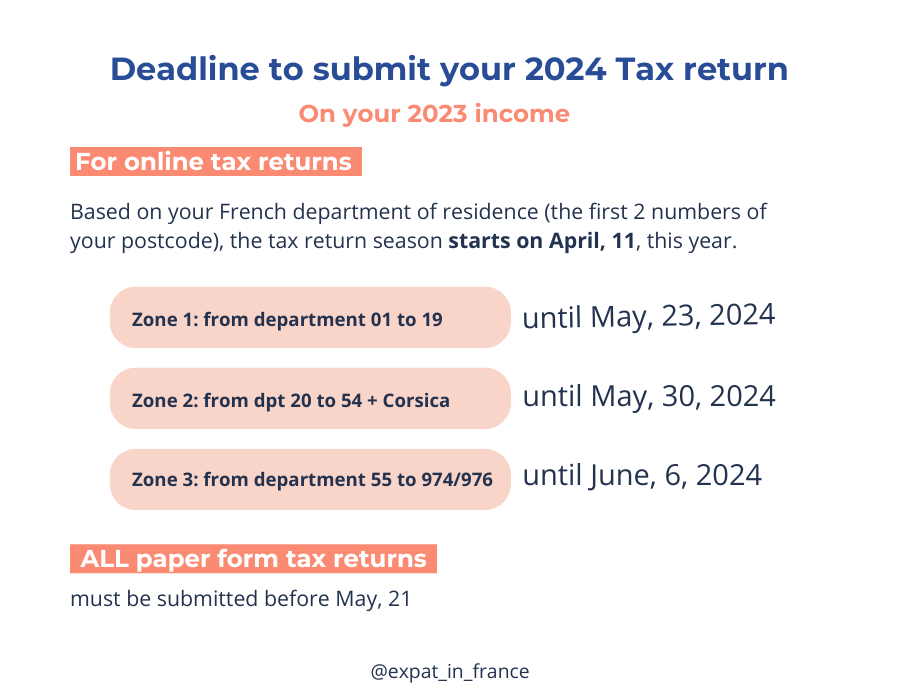

The French tax calendar

French tax return deadline

France is divided into 3 zones based on the department of residence.

Each zone will have different deadlines. The deadlines will vary every year and will also be different whether you are filing online or via paper forms:

French tax notice

Your tax notice is sent at the end of August or the beginning of September, as a back-from-holiday present!

In short

I hope it will help you a bit to navigate the French tax system. Remember that this doesn’t replace contacting a tax advisor, a service that could make you save quite a bit of money in the long term. If you need a contact, you can sen me a message.

Also, remember to keep your tax returns safely as you will need them for other French red tapes such as CAF aid requests as proof of income.

Good luck!

2 Comments

Annabelle Muff

Hey could you please give contact on someone who’s able to fill out everything for me? Since it’s all in French.

Mademoiselle Guiga

Hello Annabelle,

Please contact me on my email: [email protected].

I’ll be able to give you some contacts.

best,