Have you been asked for a RIB in France yet? No, you are not being invited to a BBQ while doing some red tape in France!

A RIB is a document you will be asked for regularly and for many administrative processes in France. And there are a few things you need to know to avoid some unexpected surprises.

The first step to getting a RIB in France is to open a bank account. If you want to know more about this, head to this specific post where I explain how to open a bank account in France.

Table of Contents

What is a RIB in France?

First, RIB means Relevé d’Identité Bancaire, which is your statement of banking identity given by your French bank.

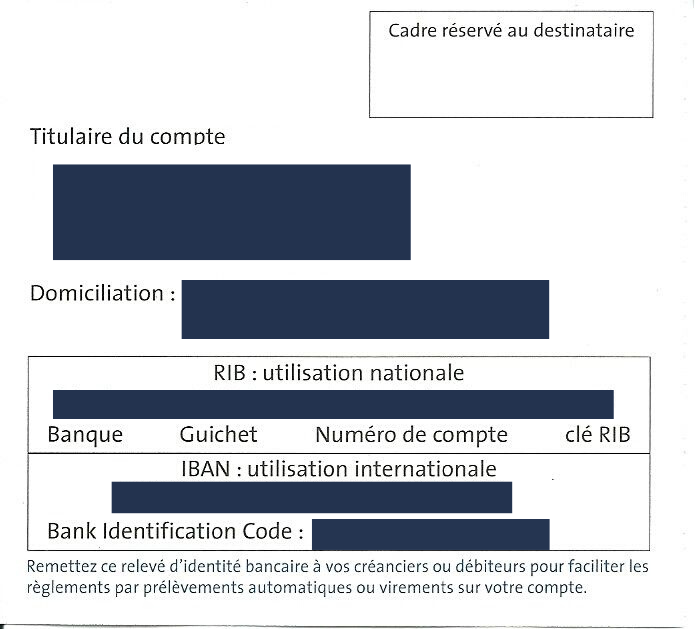

This is a form with your account number, sort codes, IBAN, and more information. In other words, it is a French bank document with your bank account details.

What information is included in a RIB in France?

You might be wondering why French banks issue a specific document just for an account number, sort codes and IBAN. Well, this is just the way it is in France. I guess it gives more authenticity to the fact that these are real bank details.

Besides these 3 basic pieces of information, you will also find on a RIB in France :

- Name of the bank (nom de la banque)

- Account Holder’s Name (Titulaire de Compte)

- Bank address (adresse de l’agence) including the bank sorting number (Code de l’agence ou code guichet)

- Your home address (domiciliation)

- Bank account number (Numéro de compte)

- IBAN (International Bank Account Number) is built as follows: Country code (2 letters) + IBAN key (2 digits) + bank code (5 digits) + branch code (5 digits) + account number (11 digits) + RIB key (2 digits).

- Bank Identifier Code or SWIFT code (BIC, your bank identifier following the international ISO norm)

When do you need it?

When you first arrive in France and set up everything, you will regularly request this document, so you may want to have it saved on your Drive, your email inbox, and also have a few paper copies in your wallet.

You will be requested this document both to make payments and receive money, either by your employer or your clients, but also by the French administration like the French Assurance Maladie that will send your medical reimbursement directly to your French account.

The RIB in France will also be asked to set up recurring payments and direct debits with energy providers for example but many other entities.

You will also need to have easy access to your French bank account details when making cash deposits but also when you’ll be cashing a cheque. The process of cashing a cheque may vary from one bank to another, but they need your IBAN number and your signature to cash it safely.

Some banks will provide you with a pre-filled booklet with your bank account details to cash cheques that you will need to sign, and other banks will request you to fill in a specific form or provide your IBAN and sign at the back of the cheque.

Is it safe to give away your French RIB?

Now you might be wondering if it is safe to distribute your bank account details around.

First, this is a document you distribute only to be paid or paying a specific company. The entity using your RIB to set up standing order payment will also need to have your signature on a document called Mandat de signature.

So, yes it is safe unless you are the victim of identity theft and forgery, but the French banking system is very secure and if this happens you will usually be reimbursed by your bank.

How to get a RIB in France

As soon as you open a bank account in France, you’ll be provided with a RIB by your bank. If you open your account in a physical bank, you’ll have quite a bit of paperwork to sign and you’ll go back with your contract, the Terms and conditions and a few RIB slips. The card will follow in the next few days.

You will also be given access to your online banking service where you can download your RIB as a PDF document for you to save or print out.

Also, if you have a French cheque book, there are always a few RIB copies at the end of the cheque book.

If you want a paper RIB and don’t have a printer, you can also get them from your bank’s ATM.

How to recognise a foreign RIB?

Now you might be wondering what the difference is between a French RIB and a non-French one if you have opened your account in France anyway.

If you go back to the IBAN structure detailed before, the two first letters indicate the bank country code.

All French IBAN will start with FR.

And since the rise of online banking, it is not rare to open a bank account in France via an online bank but with a non-French IBAN.

This means that you have opened an account with a European Bank.

The most common Neo banks you can find in France with non-French IBAN are:

- Revolut from the UK (IBAN starting by GB and soon Lituania with LT)

- Sogexia from Luxemburg (IBAN starting by LU)

- Bunq from the Netherlands (IBAN starting by NL)

- Vivid Money from Germany (IBAN starting by DE)

- ING Direct from the Netherlands (IBAN starting by NL)

Even Wise (previously called TransferWise) known as an International Money Transfer Provider created their online bank (with a Belgium IBAN starting with BE).

I don’t have feedback about their service as a bank but I’m a frequent user of their International transfer services, which I highly recommend since they are easy to use, provide great Fx rates and cheap admin fees!

Why do you need a French RIB?

If you have opened a bank account with a non-French online bank you may have been refused your RIB. French organizations tend to prefer French RIB (with an IBAN starting with FR).

However, current legislation prohibits IBAN discrimination and since European law, No 260/2012 (article 9), employers and entities have to accept non-national IBAN as long as they are part of the SEPA Zone.

It took some time for some organisations to comply but this is now the case of French public bodies such as the CAF, the tax authorities and the EDF (the National Energy provider) for example.

However, some organisations still refuse foreign RIB, even with IBAN from the SEPA zone. So, if you don’t want to initiate discussions with a mail reminding them of their obligation to accept your SEPA RIB, you may want to have another account with a French IBAN to avoid complications.

If you decide to remind them of their obligation and your IBAN is still rejected, as a victim of a violation of the law, you can file a complaint. The offender risks a fine of up to 4% of his annual turnover!

In short

In short, you do need a bank account from the SEPA zone in France, but to make your life easier I strongly recommend you have a French bank account with a traditional French bank.

You will have more simplicity to set up your direct debits and if in the long term you need a bank as a partner for your company or a real estate loan, for example, it is always good to have built a good relationship with your human banker.

*** This post contains affiliate links. If you finalise a service through those links, I may receive a small commission, at no cost to you. This is a great way to support my blog if you’re planning to take this service anyway. Thank you for your support ***