The easiest way to be registered as a freelancer in France is the status called micro-entrepreneur (a.k.a auto-entrepreneur).

You can register as a freelancer in France online without professional assistance required from a lawyer or a chartered accountant. So it is pretty flexible and also entirely free!

If you have the relevant visa or residence permit, you can be a micro-entrepreneur in France too. EU citizens can register as well! If you are not sure if your visa or residence permit allows you to be a micro-entrepreneur in France or to run a company in France or from France, you can find more information in this post.

But since no professional assistance is compulsory to create a micro-entrepreneur status and become a freelancer in France, there are often mistakes done. Making mistakes is part of the entrepreneur journey (and the expat experience too!). But the more we can avoid them, the better, right?

Let’s dive in! So, what are the five most common mistakes freelancers make when they set up their micro-entrepreneur status in France?

Table of Contents

1. Register too early your micro-entrepreneur status.

If you are under a Profession libérale visa, you will need to justify your company or micro-entrepreneur registration when you request your residence permit before the end of your first year in France.

You will already need to be invoicing clients and justify sufficient income. Sufficient income means the French minimum salary. As a general rule, wherever you are from, European, non-European or even French, it is better to register your status just before your start invoicing clients.

As a micro-entrepreneur, there are several taxes and contributions and other expenses you will have. Without getting into too many details now, one of the taxes you will need to pay is called the CFE. The good news is that you will be exempt from paying it your first calendar year after your registration.

So first, there is no need to register if you are not about to make money. Also, it is not recommended to register your status at the end of the year as you will get the exemption only for a few weeks. So, if you can wait until the beginning of the year, to start invoicing, it can be worth doing it.

Also, never register your micro-entrepreneur status after starting invoicing clients. You want to avoid problems with URSSAF, the French social contributions collector.

And, it cannot be done before your arrival in France.

It can seem a good idea to anticipate your paperwork and arrive as ready as possible in France.

However, in France, you will need two main elements to be able to register as a self-employed under the micro-entrepreneur status:

- A French address to register your business or you can choose to have a PO Box to register your business.

- Also, you will need a French bank account (with a French IBAN) and to do that you need to have a French proof of address

So it is not possible to create your micro-entreprise without residing in France. In some instances, you could but always with a lawyer.

2. Choose the micro-entrepreneur status when it is not applicable to your activity

Since it is the easiest one to administer, many people register without double-checking if this regime is possible and relevant for their activity.

There are some regulated professions that do not authorise to be run under the micro-entrepreneur status (the main ones are the ones relating to numbers, the law and medical services).

Also depending on your activity, it may not be interesting financially to set up a micro-entrepreneur status, for example, if you have many business expenses or outsource a big part of your activity. There is no possibility to deduct expenses as a micro-entrepreneur and also your social charges are calculated on your turnover and not your profit.

Also, for many entrepreneurs, the micro-entrepreneur status is the first step before creating their company status. Micro-entrepreneur or not, you are still an entrepreneur with responsibility towards your providers, your clients, the tax office and URSSAF (the social contribution collector) so it is important to be informed, proactive and fully take charge of your business and especially your obligations.

I have created a quick guide to being a micro-entrepreneur in France, you can download it for free from the link under this video.

3. Not to pay attention to scams

Registration and micro-entrepreneur administration is free.

If you receive any request of payment to register to anything just after creating your micro-entrepreneur status, these are scams and you should not pay.

When registering a micro-entrepreneur business you are automatically publically listing as a business (unless you know which box to untick).

Many scammers, but also legit companies, use these public listings to reach their target (or potential clients).

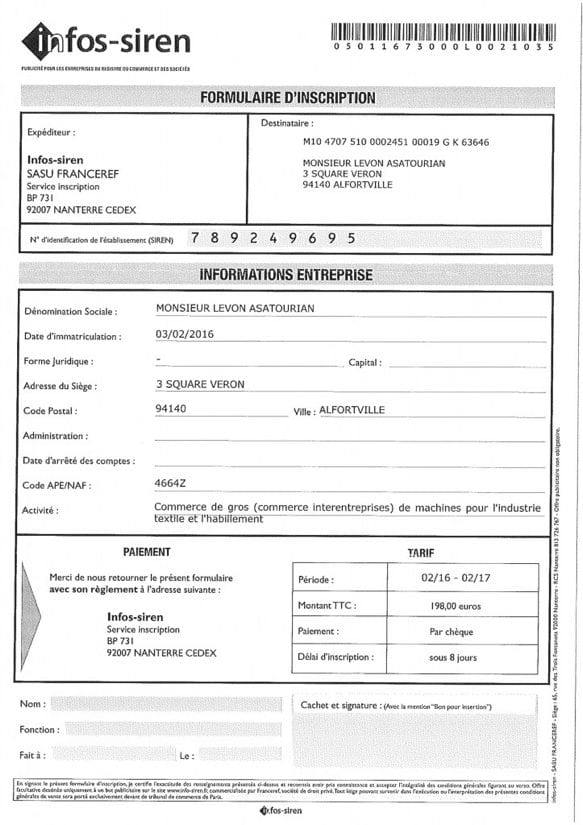

So, most newly registered micro-entrepreneurs will receive letters such as this one to ask for payment.

Other payment requests even look more official with the France flag, but there is one constant the Terms & Conditions (Conditions Générales de Ventes in French) are rarely present and if they are, they are inaccurate.

You must know that the only required payment will be the social contributions to URSSAF and it is done online on a secured platform and of course your annual income tax to the French tax office. You will find more information on micro-entrepreneur taxes and other costs in this article.

4. Not to follow closely your turnover and neglect VAT payment.

As a freelancer in France under the micro-entrepreneur status, there is a VAT exemption up to a certain turnover level. This means that before reaching this turnover you don’t need to charge it back to your client and include it on your invoices.

Once you have reached the relevant threshold, you will need to pay the VAT to the relevant countries depending on where your clients are and therefore invoice the sales tax to your client. It is therefore important to follow closely your turnover level and anticipate the VAT payment and get assistance if you need to pay the VAT or to switch to another company structure.

5. Not to save to pay taxes.

The main taxes you will have to pay as a micro-entrepreneur are the social contribution, the income tax and the VAT. But if you want to have more detailed information on this self-employed tax regime you can download the free guide below.

Many freelancers in France were previously employees and were used to receiving a salary.

Don’t think your turnover is your salary! Make sure you save to pay your taxes. And to be safe I’d recommend saving 50% of your turnover to pay your taxes and fixed charges. You can also make a simulation of your social contribution on the website in English created with URSSAF called mycompanyinfrance.fr

I hope this post will help you to avoid these 5 common mistakes done by entrepreneurs and freelancers in France, both foreigners and French people! If there is anything you’d add to the list, please share in the comments, that could help others!

2 Comments

Bradley

Great article! Is VAT ever necessary when invoicing clients located outside of the EU/EEA?

Mademoiselle Guiga

Hi Bradley,

I’m afraid this is a question much more complex than it seems and should be answered by an accountant.

Many elements should be taken into account to answer; like your status, if you are VAT exempted, what you are selling, it is B2B or B2C…

Good luck and all the best