Is the living cost in France high compared to my country?

This a question you would wonder about before moving to France! A very factual question that often leads to a subjective answer… The cost of living in a country compared to others will depend a lot on your way of life, your income level, your family structure, the currency you earn, and much more.

There is no right or wrong answer. The objective of this post is to give you information on the main cost items to be able to answer this question.

Table of Contents

Accommodation costs in France

Rental costs: the first living cost in France

Housing is usually one of the biggest parts of a household’s budget. You should count about one-third of your income just for the rent.

As per renting practices in France, landlords and rental agencies do not accept tenants if they do not earn at least 3 times the rental amount to avoid default on payments.

Obviously, the rent amounts vary a lot depending on where you live in France. You will not get the same for your money whether you live in Paris, another big city, in a distant neighbourhood or in the countryside. On average, a rental apartment in Paris costs around €33/square metre.

The housing portion of your budget can be decreased if you are entitled to CAF housing benefits. You will find all the information about this housing subsidy that many households (not only students) can claim in the free expat housing guide (from the University section of this post).

Common area maintenance charges

If you do not live in a house, you will have common area maintenance charges to pay monthly at the same time as your rent.

The projected budget for the common area maintenance charges is decided during the annual co-ownership general assembly. Depending on the type of building and services chosen by the co-ownership the cost can vary a lot.

The Association of co-owner managers (ARC) indicates that the co-owners spend an average of 46,77 euros per square metre per year. A portion of these costs (the services used by the tenants’ most common area charges, lift, …) is charged back to the tenant.

Energy costs

Gas

The household gas cost is composed of a fixed portion (the subscription) and a variable one (the consumption). The consumption cost matches the kWh consumed by the household multiplied by the kWh price sold by the gas provider you have chosen.

The kWh consumption cost varies a lot from one provider to another. I recommend you to use an online comparator website such as this official comparator one before you choose your provider as it can really impact your bill cost. UFC Que Choisir, the consumer defence association is also a good source of information.

Until December 31, 2020¹, there were 2 main categories of contracts, the Engie contracts with regulated prices and the non-regulated contract. Before 2007, only regulated energy prices were available to consumers in France.

From January 1, 2021, only none regulated contracts will be available. They tend to be cheaper. So it is worth checking your contract and maybe changing it to a cheaper one.

The average annual cost can go from 320 euros for a 30m² studio to 687 euros for a 130 m² house with Total Direct Energy, one of the cheapest providers at the moment (January 2021 average data).

Electricity

The electricity contracts work the same way as the gas ones with a fixed and a variable portion. You can even choose to take one contract with the same provider for both.

The electricity cost is also affected by the end of the regulated fees as of January 1, 2021.

Your electricity bill will vary a lot based on the provider you choose, your type of appliances if you have a full electricity property with no gas, the type and size of the property and of course the number of occupants.

The average annual cost can go from 744 euros for a 20m² studio to 3,078 euros for a 150 m² house with Total Direct Energy, one of the cheapest providers at the moment (January 2021 average data).

Water

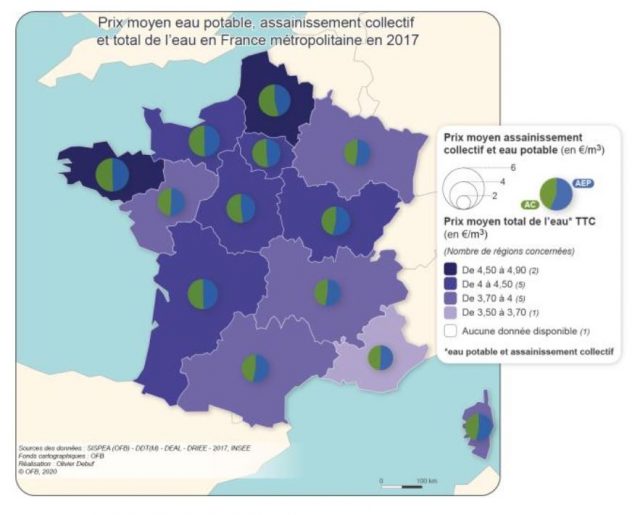

The drinking water distribution system and the sanitary sewers are managed locally by the cities and towns.

The prices vary depending on the population density but also the sewers’ capacity and towns.

Eau France – Le service public d’information sur l’eau

The average cost of water in France is €4,08 VAT included per m³ (1 000 litres).

Internet

An internet subscription with Fiber, wifi, and landline often including international calls to landlines and French TV will cost from 15 euros to 30 euros per month depending on the one you choose.

There are many discounts available in the month of January, depending on your current contract end clause, it is worth checking to save on the internet subscription.

Be aware that these discounts are usually only applicable for 6 to 12 months and then go back up to the “normal” fee.

Again online comparators are a good source of information to change your contract if you wish to.

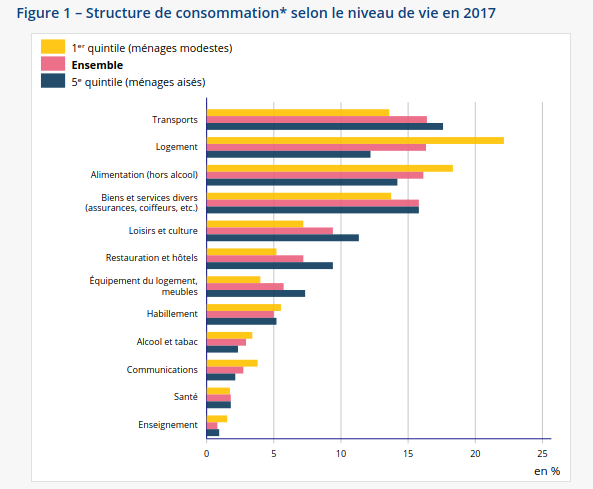

Groceries costs: the second living cost in France

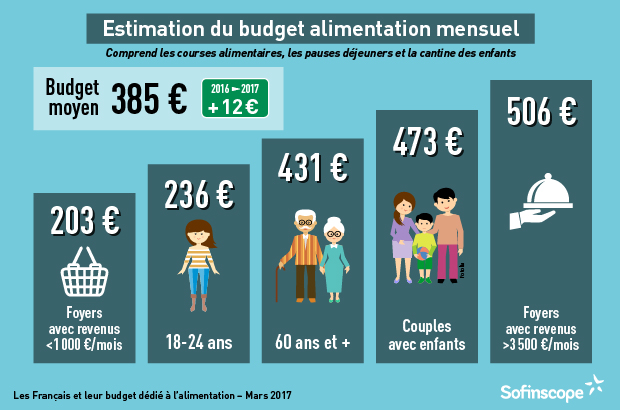

Food and other everyday expenses

Your grocery shopping budget will depend on where you shop. It is the second item in terms of living costs in France for the more modest families. It represents 22% of their monthly budget!

The price will vary a lot if you do most of your shopping in discount shops or organic shops, just to take the 2 extremes of the price range. However, if you go to a common supermarket, the price will also vary a lot as per the below illustration study.

Lunch expenses

If you are employed and depending on the employers, you may receive a ticket-restaurant or have access to a subsidised on-site canteen.

If you receive restaurant tickets, your employer will contribute to the cost from 40 to 60% of the amount indicated on the voucher. The rest will be deducted from your payroll depending on the number of days worked during the month.

You can use your restaurant ticket to pay for your lunch but also do your grocery shopping in most supermarket chains, and fruit and vegetable shops.

Be careful, the restaurant ticket has an expiry date! You can use them for the year indicated on the ticket with an extension of the first 2 months of the following year. So, for example, if you still have 2020 restaurant tickets, you have until February 28, 2021, to spend them.

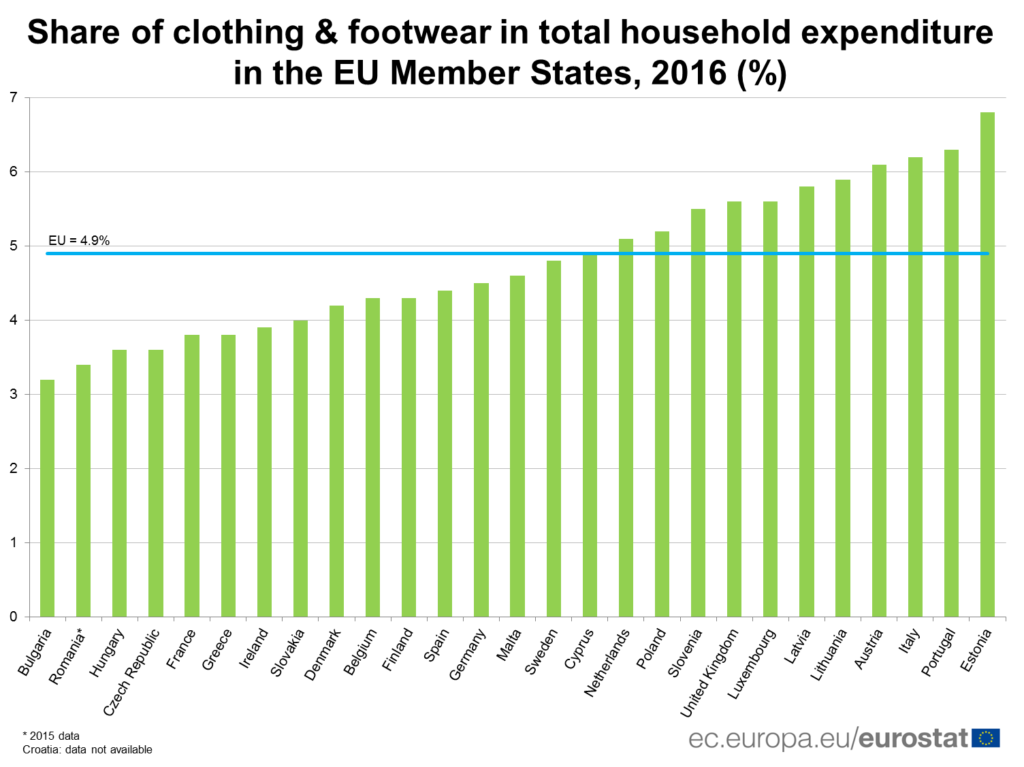

Clothing cost: a surprising living cost in France

France is one of the EU countries spending less on clothing! Quite ironic if we consider France as the country of Haute Couture and fashion!

French people spend an average of 536 euros per year on clothing and 132 euros on shoes per year in 2016. There are two main reasons for these low expenses compared to its neighbours:

- importation of cheaper products

- the increase in discount prêt-à-porter chains

This is the living cost item that decreased the most in France since the ’60s!

The sales are regulated by law in France. The two main sales periods are:

- the winter sales: starting on the second Wednesday of January for 4 weeks

- the summer sales: starting on the last Wednesday of June for 4 weeks

The best deals are usually done on the first week (or even the first days) and the last week.

Transportation costs

Public transportation: a subsidised living cost in France.

Public transportation in France is quite affordable compared to other European countries. It receives public subsidies to keep the prices affordable.

In addition, all employers in France have the obligation to pay 50% of their employees’ public transport subscription costs from their homes to their places of work.

As an example, the monthly public transport monthly subscription costs 64 euros in Lyon and 75 euros in Paris. To which, employees will receive 50% reimbursement. There are also discounts for specific populations such as students, seniors, people receiving low incomes or families with more than 3 children.

Petrol and toll costs

Diesel and petrol cost: a highly taxed living cost in France

Petrol and diesel are quite expensive in France compared to other countries such as the USA. The price indicated at the petrol station includes the 20% VAT cost. This high tax on petrol increases significantly the living cost in France and even more for people living in rural France with lower incomes depending on a vehicle.

The price varies from one petrol station to another. The stations on the highway can be about 20% higher!

This official website will help you find the cheapest petrol station in your area and also on your way to your French holiday destination.

Toll cost

After the 2020 annual increase of 0,90% in February 2020, the government announced that the 2021 increase will be between 0,30 and 0,65%.

As is the case every year, the toll cost increase is implemented on February 1st.

Train tickets

The French railway network is very dense. It is managed by the SNCF.

You can choose between slower trains (TER) mainly regional but also inter-regions, the high-speed inter-regions (TGV).

The SNCF launched a few years ago low-cost inter-region high-speed trains: the OUIGO. The price is much cheaper but the comfort and space decreased and you may need to go to more distant stations. So before confirming your OUIGO book, double-check where the stations are located.

There are many different types of discount cards available that you would buy annually. Their cost is 49 euros and is usually recouped after one return trip.

SNCF does regular discounts and prices tend to be cheaper when booked in advance. Tickets are available for purchase 4 months in advance, except OUIGO which can be more and the EUROSTAR will be 6 months in advance.

The full price for a return TGV ticket from Paris to Lyon would be between 100 to 150 euros in second class and if you get a good discount for 50 euros returns sometimes less.

Insurances

Health insurance: a hidden living cost in France

Many people make the assumption that the public French public healthcare is free as we don’t receive invoices or a clear payroll deduction. It is clearly not free and even though the employees are only deducted about 1% of their gross salary, we should also take into account the employer’s contribution. It is 13% on top of the gross salary.

You may be aware that employers pay about 46 to 48% in employer charges on top of your annual salary among which is the healthcare contribution.

France has a “repartition” welfare system (as opposed to a capitalization system) therefore the net salaries are lower than in other countries where an individual would have to pay for their own private health coverage.

Besides public healthcare which usually covers between 60 to 80% of the medical costs, people can also take out private top-up insurance called Mutuelle. Employees get a mutuelle negotiated by their employer at preferable rates with a minimum of 50% paid by the employer.

For a family of 4, it can vary from €45-€150/month, depending on the level of coverage chosen.

Home insurance and civil liability insurance

Taking civil liability insurance is compulsory in France. This insurance covers the material and physical damages to third parties both at home and outside.

Home insurance is not compulsory but highly recommended for both tenants and owners. The insurance will cover the property content but also the property itself in case of damages. Most owners will request their tenants to provide a home insurance attestation when renting a property.

The average cost of multiple-risk housing insurance (including liability and home insurance) is about 180 euros/year in France (152 euros/year for an apartment and 235 euros/year for a house).

Car insurance

If you drive through France you may wonder if you need to take out car insurance. In some cases, you may be exempted from taking one. Find more details in this post about compulsory insurance in France.

The average car insurance annual cost was 632 euros in 2020 against 566 euros in 2015! The insurance companies announced an increase of the 2021 premiums of 1,5 to 2% despite the decreased use of the vehicles during the lockdowns.

➡️ Everything you need to know about the compulsory insurances in France

Guiga from expat in France

Education costs

Daycare

Most parents hope to get a spot in a public daycare, called crèche as it offers cheaper prices for a quality service. However, it is relatively difficult to get a full-time spot (more than 20 hours per week). Only 13% of families get a full-time spot according to the 2018 Ernst&Young study.

Registration requests are to be done as soon as you know you are expecting a baby to have more chances to get a spot. Children can start as young as 3 months old. The attribution system varies from one city to another. Your best source of information will be your local town hall.

The price is based on income. On average for a 40-hour week, the monthly cost is around €800 for high-income earners. At the low end, the price can be about €50/month. You can make an estimation of the crèche cost on the CAF website.

If you cannot get your child into a crèche, you can get a nanny (assistant-e maternel-le) instead. The government agency, CAF covers a portion of the costs, bringing down the price to about as much as a crèche.

School

Education costs from the age of 3 represent a low living cost in France if you choose public schools.

Maternelle (from 3 years old) to public secondary school is free in France. Some additional services like an early drop-off, late pick-up, and school canteens have an extra cost. The prices are based on income and will vary from one town to another. For example, in Lyon, a child can eat at the cheapest for 0,80 cents/day up to 7,30€/day in 2020/2021!

➡️ More information about International schools in France

Guiga from expat in France

University

Public universities are very affordable in France. This cost item doesn’t significantly impact the living cost in France compared to other countries.

- €170 / year at the licence level (bachelor)

- €243 / year at the master level

- €601 / year in a school of engineering

- €380 / year at the doctoral level

Please note that differentiated tuition fees for some non-EU students depend on their status:

- €2,770 / year at the licence level (bachelor)

- €3,770 / year at the master level

More information on the Campus France official website.

There are also private universities. The prestigious ones are called the Grandes Ecoles and they are also more expensive. Average private universities’ annual tuition fees will cost from €3,000 up to €8,000. However, the Grandes Écoles can go up to €15,000 per year!

Also, students in France can receive a housing subsidy. From January 1, 2021, housing aid called APL will be calculated based on the past 12 months’ revenue, instead of income from two years prior.

For more information on how to claim this income-based housing aid (also available to non-students), download the below expat housing guide.

Entertainment

Eating out

To tip or not to tip in France?

Giving a tip is the exception for a French person. Customers would tip if they are especially happy with the service. The bill already includes the service charge. Also, the staff do not rely on tips to make a decent living in France as can be the case in other countries.

Remember, that the price you see on the bill is the full price, including the VAT.

Museums

Museums offer EU citizens under 25 free access and often for non-EU citizens under the age of 18.

There are also reduced prices for the unemployed, handicapped, and other special classes.

Most museums, mostly the municipal ones, give free admission for their permanent collections on the 1st Sunday of every month.

Depending on the museum, it is common to pay between 8 to 15 euros or even more for famous Parisian museums. The Versailles castle full entry fee is €18.

Entry is free on European heritage day. This is a full weekend of free museums and special exhibitions open to the public this weekend only, every year on the 3rd weekend of September.

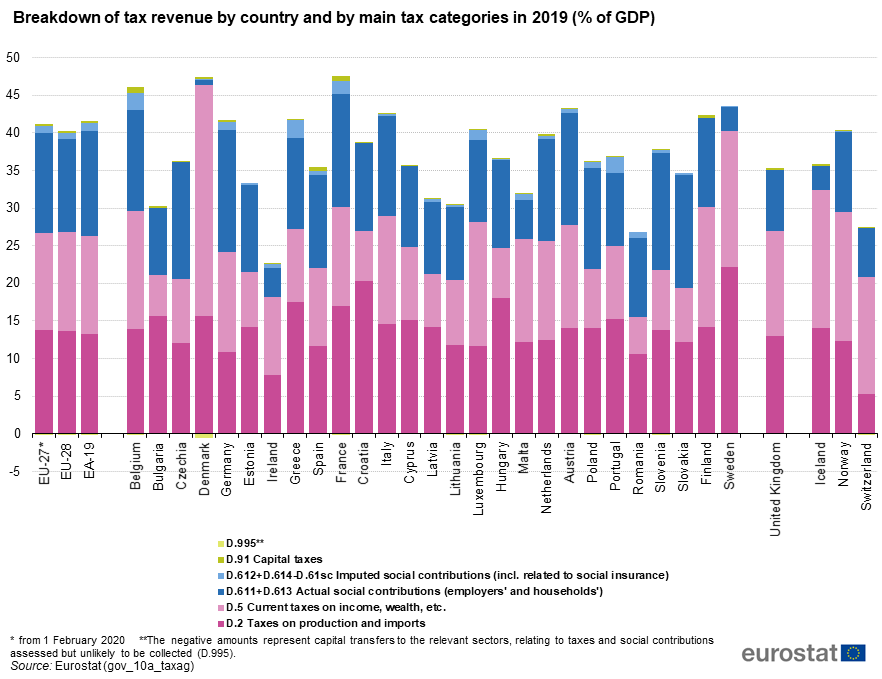

Taxes in France

VAT

The VAT is a flat sales tax. The VAT normal rate in France is 20%. Slightly lower than the EU average of 21,50%. There are also reduced VAT rates:

- 10% (restaurants, museums and monuments, passenger transport…),

- 5,5% (gas and electricity, groceries and fresh food, hygiene products, movies and live performances…)

- 2,1% (medicines reimbursed by CPAM, some press publications, specific live performances…)

The price usually includes the VAT. It is indicated TTC (Toutes Taxes Comprises – All taxes included). If it is not included it will state the amount HT (Hors Taxe – Without Tax).

Income tax

An income tax return should be filed in France in April-May for the previous calendar year’s incomes. Filing taxes doesn’t necessarily mean paying taxes, especially if you pay taxes in another country. In that case, you should check if there are any bilateral agreements to avoid double taxation. I also strongly recommend you contact a tax advisor to help you with this complex task.

Taxation is quite high in France. It ranks at the top of the EU countries with Denmark and Belgium.

The income tax structure in France goes as follows for the 2020 incomes (to be declared in April 2021). Many other criteria will also impact the tax applied to your situation. This is only an indication.

| 2020 Income scales (taxable amounts) | Tax rate to apply to the corresponding income portion |

| Up to €10,084 | 0% |

| From €10,085 to €25,710 | 11% |

| From €25,711 to €73,516 | 30% |

| From €73,517 to €158,122 | 41% |

| Over €158,123 | 45% |

➡️ More information about the French tax return

Guiga from expat in France

Salaries in France

The French minimum salary has been increased by 0,99% as of January 1st, 2021. The 2020 inflation was about 0,50% according to INSEE, the French National Statistic Office. The hourly rate goes from €10,15 gross to €10,25. This represents €1 554.58 gross/month for a full-time 35h/week job.

Considering the high tax and social contribution system paid by individuals but also by companies, the net income is quite low compared to other countries. However, in parallel, many people get access to financial subsidies such as the housing aid mentioned above or family benefits.

The living cost in France appears to be quite high for the first fifth of the population earning the lowest income (in yellow on the below table). The portion of fixed-cost items, such as housing or food, is very high compared to the average population or the highest salaries (in blue).

➡️ Find out more about French minimum salary and median salary

Guiga from Expat in France

Comparing the living costs in French cities

The website Numbeo is a great free source of information on the cost of living in the world. You will usually find data for the big cities. Unfortunately, they do not have much data for middle-size cities and the countryside.

You can even compare the cost of living in France with your home town. I have put together a summarised comparison of some French cities with Paris from Numbeo data to give an idea of the differences in the cost of living in France.

French cities living costs compared to Paris – January 2021

| Lyon (517,000 people) | Nice (339,000 people) | Strasbourg (285,000 people) | |

| Consumer prices | -13,08% | -13,11% | -13,27% |

| Rent prices | -44,22% | -28,11% | -49,10% |

| Restaurant prices | -17,09% | -8,02% | -18,16% |

| Groceries prices | -14,56% | -18,62% | -17,44% |

| Local purchasing power | 5,67% | -2,42% | 6,99% |

| Quality of life index (Paris index: 118,09 in Jan 2021) | 149,18 | 149,41 | 171,82 |

Is it expensive to live in France?

It depends and as I said before it is a very subjective response and will depend on your family situation. My answer would be:

- YES, if: you earn less than €1,500 and don’t have access to specific discounts or aids. It will be especially true when living in a large city.

Optimising a budget can take some time for an expat. Comparing offers and prices can make a big difference. I hope the comparators and tips provided in this post can help you to plan and manage your budget. Also, as you can see, life in Paris is extremely expensive compared to other big cities in France. So if you are earning under the French median salary in Paris, it can be a struggle.

Therefore, if you have the choice, living in other cities or towns will give you a better quality of life.

- No, if: You earn over €1,500 and know how to maximize your budget. From €2,000/month you can have a more comfortable life (outside Paris).

What is your experience on the living cost in France as an expat?

Let us know in the comment section below. Thanks for sharing!

Other references:

[¹] Law n°2019-1147, November 8, 2019

Liked this post? Save it for later!